Dave Sieck- Iowa House District 16

House Supports Minority/Veteran Owned Small Businesses

House File 872 passed the House Floor this week. The bill updates the Targeted Small Businesses (TSB) program run by the Iowa Economic Development Authority.

Iowa’s TSB Program is designed to help women, individuals with minority status, service-disabled veterans, and individuals with disabilities overcome some of the hurdles to starting or growing a small business in Iowa.

To meet the minimum requirements for TSB Certification, a business must:

Be located in the state of Iowa.

Be operated for a profit.

Have less than $4 million in gross income, computed as an average of the preceding three fiscal years.

Be majority-owned (51 percent or more), operated and managed by a female, individual with minority status, service-disabled veteran, or individual with a disability.

House Study Bill 872 provides that to qualify a business can have up to $10.0 million in gross income. This will allow more small businesses to be part of the program. The bill is now moving to the Senate for further consideration.

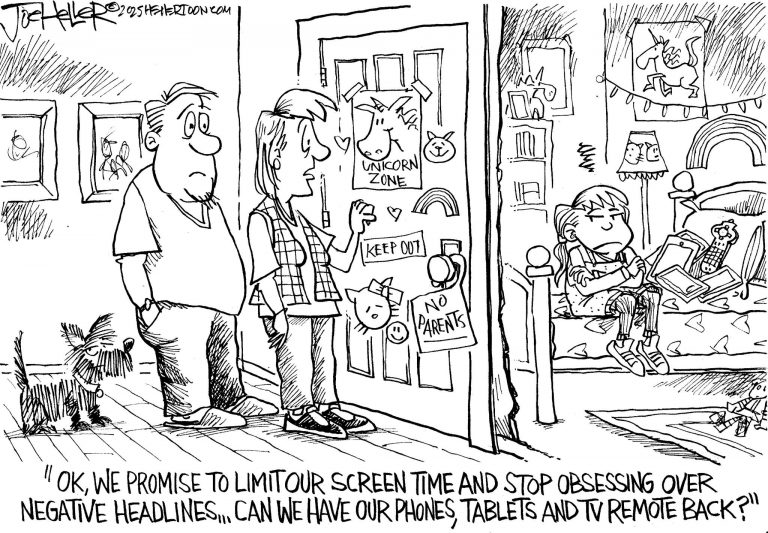

Property Tax Cut for Childcare Centers

Childcare affordability and availability are topics House GOP lawmakers have long made priorities.

House Study Bill 316 passed the House Ways and Means Committee this week and moves in the right direction for both goals.

The legislation provides that childcare centers will be given the residential rollback (instead of commercial) for property tax purposes.

Simply put—it is a tax cut for commercial childcare centers. We all know that when their costs go down, they can create more slots and keep prices more affordable.

Current law provides that a childcare center is a commercial property and is assigned a 90 percent rollback. This means they pay property tax on 90 percent of their assessed value.

House Study Bill 316 provides that for assessments years beginning January 1, 2025 and after—property that is primarily used as a childcare center—although a commercial property—will be given the same rollback as residential property on the amount of actual value used as a childcare facility.

The residential rollback changes every year and this year it is 47.4 percent. This will result in a property tax cut for these businesses.

The bill provides that a person who wishes to qualify for this rollback must file an application with the assessor by July 1 of the assessment year for which the person is first requesting the limitation on forms provided by the Department of Revenue.

The license to operate as a childcare center must be included with the application. The person will not have to apply in subsequent years as along as the property is still used for this purpose.

The bill provides that each county’s board of supervisors shall determine eligibility of applicants by September 1 of each year. There is a process for appealing a decision.

Additionally, if a property is receiving the residential rollback, but no longer is being used as a childcare center—the taxes that would have been owed will have to be paid back.

The bill now moves to the House Floor.

Upcoming Legislative Forums

April 5- 8 am- Malvern, Mills County Extension Office- 61321 315th St., Malvern

-10 am- Sidney, United Faith Church, 1975 US 275, Sidney

Stay Connected

Please feel free to contact me by email at david.sieck@legis.iowa.gov or by phone at 515.281.3221 with any questions or concerns.